In 2016 the Inland Revenue Board of Malaysia lowered the effective tax rate to 24 for businesses with capital exceeding 25 million ringgit. HOUSEHOLD GROSS INCOME.

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

A non-resident individual is taxed at a maximum tax rate of 28 on income earnedreceived from Malaysia.

. Heres How A Tax Rebate Can Help You Reduce Your Tax Further. The Goods and Services Tax GST is an abolished value-added tax in Malaysia. Buildings that are used with the sole purpose of approved business or expansion project as a BioNexus Company will get an industrial building allowance of 10 for a period of 10.

GST is levied on most transactions in the production process but is refunded with exception of Blocked Input Tax to all parties in the chain of production other than the final consumer. Income Tax slab rates help you decide whether your income is taxable or not. The finance minister has introduced many changes in the income tax slab rate for financial year 2019-2020 AY 2020-2021.

CIT solidarity surtax and municipal business tax for Luxembourg City is 2494. This page provides - India Personal Income Tax Rate - actual values historical data forecast chart statistics economic calendar and news. Our Malaysia Corporate Income Tax Guide.

Find Out Which Taxable Income Band You Are In. These Are The Personal Tax Reliefs You Can Claim In Malaysia. Income that is attributable to a place of business as defined in Malaysia is also deemed derived from Malaysia.

Inland Revenue Board of Malaysia shall not be liable for any loss or damage caused by the usage of any. For the smaller companies the rate is 19. They enjoy an income tax holiday of up to eight years.

Median household income in urban recorded an. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. The municipal business tax for Luxembourg City is 675.

This page provides - United States Personal Income Tax Rate - actual values historical data forecast chart statistics. Calculations RM Rate TaxRM 0-2500. The tax rate is concessional at 20 of the statutory income derived for businesses that are approved after the tax exempt period is expired up to a period of 10 years.

Malaysia follows a progressive tax rate from 0 to 28. Crude rate of natural increase in Malaysia 2015-2020 by ethnic group Crude birth rates in Malaysia 2011-2020 Fertility rates in Malaysia 2015-2020 by ethnic group. A company or corporate whether resident or not is assessable on income accrued in or derived from Malaysia.

No tax is applicable for individuals whose income is. The Malaysian government also imposes government taxes such as the Sales and Services tax and real estate taxes. Moreover mean income rose at 42 per cent in 2019.

Thereafter a preferential gross income tax rate of 5 is imposed which is in lieu of national and local taxes including the RCIT MCIT and the IAET VAT and percentage taxes excise taxes and DST. In terms of growth median income in Malaysia grew by 39 per cent per year in 2019 as compared to 66 per cent in 2016. The Personal Income Tax Rate in the United States stands at 37 percent.

The government has also included a new condition whereby this concessionary income tax rate of 17 will only give to a Company having gross business income from one or more sources for the. In 2019 mean income in Malaysia was RM7901 while Malaysias median income recorded at RM5873. Average Lending Rate Bank Negara Malaysia Schedule Section 140B Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs.

Assessment Year 2016 2017 Chargeable Income. On the First 5000. Entities registered in special economic zones are subject to a separate tax regime.

The existing standard rate for GST effective from 1 April 2015 is 6. Calculations RM Rate TaxRM. An individual is a non-resident under Malaysian tax law if heshe stay less than 182 days in Malaysia in a year regardless of hisher citizenship or nationality.

How Does Monthly Tax Deduction Work In Malaysia. With effect from Wef 1 January 2022 income derived from outside Malaysia and received in Malaysia by tax residents will be subject to tax. Municipal business tax on income.

Chapter 3 - Table 32 Total tax revenue in US dollars at market exchange rate Chapter 3 - Tables 37 to 314 - Taxes as of GDP and as of Total tax revenue Chapter 3 - Table 315 - Tax revenues of subsectors of general government as of total tax revenue. On the First 2500. The effective combined CIT rate ie.

Municipal business tax is levied by the communes and varies from municipality to municipality. Personal Income Tax Rate in India averaged 3239 percent from 2004 until 2020 reaching an all time high of 3588 percent in 2018 and a record low of 30 percent in 2005. The Personal Income Tax Rate in India stands at 3588 percent.

Personal Income Tax Rate in the United States averaged 3671 percent from 2004 until 2020 reaching an all time high of 3960 percent in 2013 and a record low of 35 percent in 2005.

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

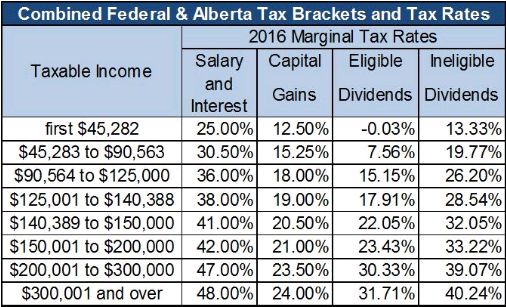

2016 Alberta Budget Capital Gains Tax Canada

Malaysia Personal Income Tax Rates Table 2010 Tax Updates Budget Business News

Individual Income Tax In Malaysia For Expatriates

Honduras Personal Income Tax Rate 2022 Data 2023 Forecast 2004 2021 Historical

Why It Matters In Paying Taxes Doing Business World Bank Group

10 Things To Know For Filing Income Tax In 2019 Mypf My

How To Maximise Your Income Tax Refund Malaysia 2019 Ya 2018

Malaysia Taxable Income Mariodsxz

Malaysia Five Takeaways From The New Oecd Economic Survey Ecoscope

Malaysian Personal Income Tax Pit 1 Asean Business News

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Malaysia Personal Income Tax Rates 2013 Tax Updates Budget Business News

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Income Tax Formula Excel University

Malaysian Tax Issues For Expats Activpayroll

Laws Free Full Text Tax Policy In Action 2016 Tax Amnesty Experience Of The Republic Of Indonesia Html